Effective as of January 1, 2018, the recently enacted Tax Cuts and Jobs Act (“TCJA”) made many significant changes to the tax law, including the area of estate and gift taxes. These changes present an opportunity to take advantage of a historically large exemption amount, and should also prompt a review of existing estate planning documents and beneficiary designations (particularly if such plans were made based on the much lower exemption amounts before 2010).

Temporary Increase in Federal Estate, Gift, and Generation-Skipping Transfer (“GST”) Tax Exemption Amount

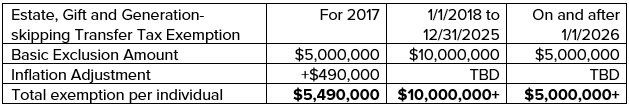

Increased Exemption. For 2017, individuals had an exemption of up to $5.49 million against Federal estate, gift, and generation-skipping transfer taxes ($10.98 million for a married couple). For 2018, those exemptions are now doubled, to approximately $11.2 million per individual (or $22.4 million for a married couple). The exact amounts for 2018 are yet to be announced by the IRS, and inflation adjustments for 2018 and future years will also affect the exact amount of the exemptions.

Rate. Transfers in excess of the available exemption continue to be taxed at a rate of 40%.

Portability. The “portability” of a deceased spouse’s unused exemption remains available, allowing transfer of a deceased spouse’s unused estate tax exemption (but not GST tax exemption) to a surviving spouse as long as a Form 706 estate tax return has been filed for the deceased spouse’s estate. Through use of portability, a married couple can take advantage of the full $20,000,000 exemption (indexed for inflation).

Sunset Provision. On January 1, 2026, the exemptions will return to the pre-2018 exemption levels ($5 million per person, adjusted for inflation), unless Congress acts to extend the new exemption amounts. It is always possible that the TCJA could be repealed by Congress in the future. A remaining question is whether gifts made in this time frame (2018–2025) will later be subject to “clawback”, however, guidance from the IRS is anticipated to confirm that gifts will not later be subject to tax if the exemptions are reduced.

Annual Exclusion Amount Increase. Also, in 2018 the annual exclusion amount for gifts is increased from $14,000 to $15,000 per donee (thereby allowing spouses to make joint gifts up to $30,000 to each donee). This is a result of an inflation adjustment by the IRS and not the new law.

Planning Considerations

Review Your Estate Plan

To put the current $11.2 million exemption in context, it is important to remember that the estate tax exemption has historically been much lower. Five years ago (2013) the exemption was $5.25 million, ten years ago (2008) the exemption was at $2 million, and fifteen years ago (2003) the exemption was at $1 million. While the exemption has steadily increased in recent years, the Obama administration had proposed returning the exemption to the $3.5 million level from 2009, and it is possible that future administrations may also consider reducing the exemption.

While most taxpayers will not pay the estate tax with the higher exemptions under TCJA, the new exemption could dramatically alter the outcome of an estate plan. For that reason, there are still many reasons to complete or update estate plans. Older estate plans may have been drafted based on the historically low exemptions and used formula bequests that put an exempt amount into a trust. With the much higher exemption amount, this may cause the trust to receive a much larger portion of assets than was anticipated when the documents were signed. Such tax-motivated trust planning may no longer be appropriate, although there remain other significant benefits to using trusts (such as asset protection, management assistance, or blended-family planning). Accordingly, estate planning documents should be reviewed and/or updated for flexibility purposes, including the use of “second look” strategies for after the first spouse’s death, such as disclaimer trusts, QTIP trusts, and Clayton trusts.

Portability Election

The benefits of the portability election remain important, particularly if there is a death of a spouse while the higher TCJA exemptions are in place. Portability could allow the second spouse to have the benefit of the deceased spouse’s $10 million exemption (adjusted for inflation) even if the second spouse dies when the exemptions return to the lower $5 million amount.

Gifting to Capture Benefits

Because the current exemptions expire at the end of 2025, affluent individuals will want to consider securing use of the increased exemption while it is available. The increased exemption could be leveraged to make gifts to new or existing trusts, thereby removing the gifted property from the donor’s estate and any future appreciation on the gifted property. However, the loss of an opportunity to obtain a basis “step-up” (discussed below) should also be considered when selecting certain assets for such lifetime gifts.

Basis Planning

No changes were made by the new law to the rules for a “step-up” (or “step down”) in tax basis for assets held at the time of death by the decedent.

Basis “Step up”. Usually, your basis is what you paid for an asset. When a purchased asset is later sold, the appreciation on the asset can result in taxable gain on the difference between the sales price and what the owner previously paid. It is possible to avoid this gain completely, however, by allowing beneficiaries to inherit the asset upon the owner’s death. For most assets other than retirement accounts and annuities, when an asset is inherited the asset’s basis receives a “step up” to the fair market value on the date of death. This can be especially valuable in highly-appreciated property such as real estate or art.

Carryover Basis for Gifts. Lifetime gifts will continue to pass to the recipient with the donor’s tax basis. The larger exemption amount means that an individual may hold more assets until death without estate tax exposure, so it may be more advantageous to not gift low basis assets so that such assets may obtain a basis adjustment at the owner’s death and reduce or eliminate significant taxable gain due to appreciation in value. This will allow children or beneficiaries to later sell the asset with less taxable gain.

Irrevocable Trusts. For beneficiaries of irrevocable trusts, trusts that hold low-basis assets should be reviewed to determine whether there is a benefit to causing the trust to be included in the estate of the beneficiary, thereby allowing the assets to receive a step-up in tax basis at the beneficiary’s death. Such planning may or may not be desirable (or possible) for a variety of reasons, and individuals should consult with an estate planning attorney on such planning.

WHAT NOW?

If you have questions about how estate taxes affect you or your estate, we can help. We offer initial consultations at no charge, and you may schedule an appointment by emailing us at info@tarletonfirm.com or giving our office a call at (214) 935-9004. We are located in Dallas, but serve clients all over Texas.

This article is intended for general information purposes only. It does not constitute legal advice. The reader should consult with knowledgeable an estate planning attorney to determine how applicable laws apply to specific facts and situations. This publication is based on the most current information at the time it was written. Since it is possible that the laws or other circumstances may have changed since publication, please call us to discuss any action you may be considering as a result of reading this publication.