When determining which assets require the probate process, it is important to understand the difference between assets that are categorized as “probate” assets versus those that are “non-probate” assets.

PROBATE ASSETS. These are assets that are held in the deceased individual’s name at the time of his or her death, and are distributed by the probate process to the heirs or beneficiaries of the estate. Such assets generally consist of any of the assets that are not otherwise distributed through a non-probate process, as described below. The probate process used to transfer a probate asset can vary depending on the type of asset and whether a Will exists. When a valid Will exists and the Will appoints an Independent Executor, the probate process can be relatively simple in Texas. To see what the independent administration process looks like, please click here.

NON-PROBATE ASSETS. Other assets are described as “non-probate assets” and do not require the probate process to be transferred to the heirs or beneficiaries. Such assets may include the following:

> Life insurance or retirement accounts for which the deceased owner properly completed a beneficiary designation.

> Accounts held in the deceased individual’s sole name, and that name a “pay-on-death” (POD) or “transfer on death” (TOD) payee. For such accounts, once the account owner dies, the assets are transferred by the institution where the account is held (such as a bank) to the payee as the new owner.

> Property that is held as “joint with rights of survivorship” with a spouse or other individual. These assets will pass to the surviving joint owners upon a joint owner’s death.

> Property held in a trust, whether established by the deceased person during his or her lifetime (such as a Revocable Living Trust) or that was established by someone else for the benefit of the deceased person (usually an irrevocable trust).

JOINT ACCOUNTS. In Texas, it is important to understand the status of the law regarding multi-party accounts. Under current Texas law, an account that is designated as “JT TEN”, “Joint Tenancy”, “joint”, or with other similar language alone will not qualify as creating a survivorship right to the account (Texas Estates Code Section 113.151). Thus, under Texas law, there is no presumption that a joint account intends to create a survivorship right. An account that is merely “joint” will not pass to the other parties on the account but will instead be transferred as part of the deceased account owner’s estate, in proportion to the deceased account owner’s net contributions to the account. If the intent is to create a survivorship right to the account, so that upon one owner’s death the interest in the account passes to the other parties on the account, then the account must have some type of “survivorship” designation on the account signature card.

Individuals who use joint or survivorship accounts may not have understood the effect that such accounts will have on the distribution of their estate at death. This lack of understanding regarding the rules for multi-party accounts may result in assets unintentionally being non-probate assets, and thereby may also result in frustration by the heirs or beneficiaries. For example, a parent might name a child as a POD beneficiary on a large account when the actual intent is to have the POD beneficiary child divide the account assets among the child and other family members – in such cases the risk is that the child will keep the property from the account and not agree to divide the property among family members as intended. Or, a parent may have named the child as a survivorship beneficiary on a joint account when the intent was actually to have the account transferred pursuant to the parent’s Will, and so the parent should not have included the survivorship designation on the account.

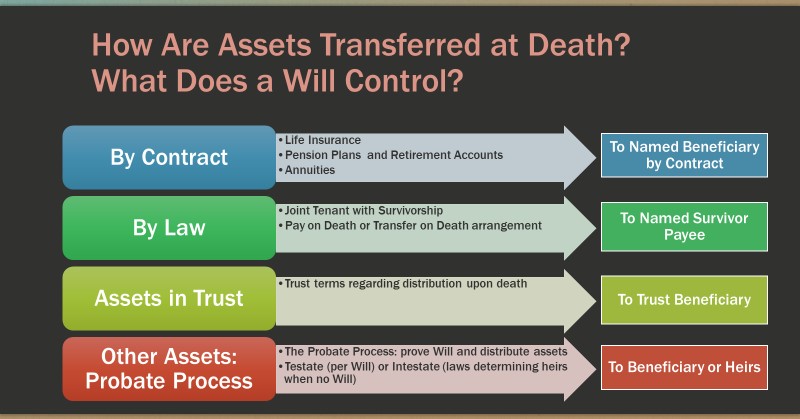

Non-probate assets and joint accounts can avoid probate, since such assets are transferred through contract rights. The following diagram illustrates how assets in a deceased person’s estate may be transferred, including through non-probate methods:

As illustrated by the above diagram, property may pass through methods other than probate depending on how the property is held. From an estate planning perspective, it is important to make sure that the effects of how decisions on how to title property can affect who receives property at death. Once a loved one has passed, it is also important to understand how such rules affect whether property is to pass directly to an individual through contractual or other rights, or if going through the probate process will be necessary to change title to property to the beneficiary’s or heir’s name.

WHAT NOW?

This article explains only some of the legal aspects of probate and transfer of assets upon death. For more information, contact us at info@tarletonfirm.com or at (214) 935-9004. We are located in Dallas, but serve clients all over Texas.

This article is intended for general information purposes only. It does not constitute legal advice or create an attorney-client relationship. If you have questions about an estate, you should consult with an experienced Texas probate attorney to determine how applicable laws apply. This publication is based on the most current information at the time it was written. Since it is possible that the laws or other circumstances may have changed since publication, please call us to discuss any action you may be considering as a result of reading this publication.